When is the Best Time to Buy a House?

Purchasing a house is a significant decision, and timing can play a crucial role in getting the best deal and finding the right home. Whether you're a first-time buyer or a seasoned investor, understanding the optimal time to buy a house is essential. Making a well-timed purchase can result in significant savings, increased negotiation power, and a higher likelihood of finding the ideal property that meets your needs. Many prospective buyers wonder, "When is the best time to buy a house?" While there is no one-size-fits-all answer, this article will explore key factors to consider when determining the optimal timing for your home purchase.

Factors Influencing the Best Time to Buy a House

Market Conditions. The real estate market's conditions heavily influence the timing of a home purchase. Understanding the distinction between a seller's market and a buyer's market is crucial. A seller's market occurs when demand surpasses supply, leading to increased competition and higher prices. On the other hand, a buyer's market arises when the number of available homes exceeds the demand, resulting in more negotiation power for buyers. Supply and demand dynamics have a direct impact on housing prices, with data indicating that during a buyer's market, prices can be up to 10% lower than during a seller's market. Additionally, fluctuations in interest rates play a significant role in affordability. According to Shamrock Home Loans, for every 1% interest rate increase or decrease, your purchasing power may be decreased or increased by 9 to 11%, potentially saving or costing thousands of dollars over the life of a mortgage.1

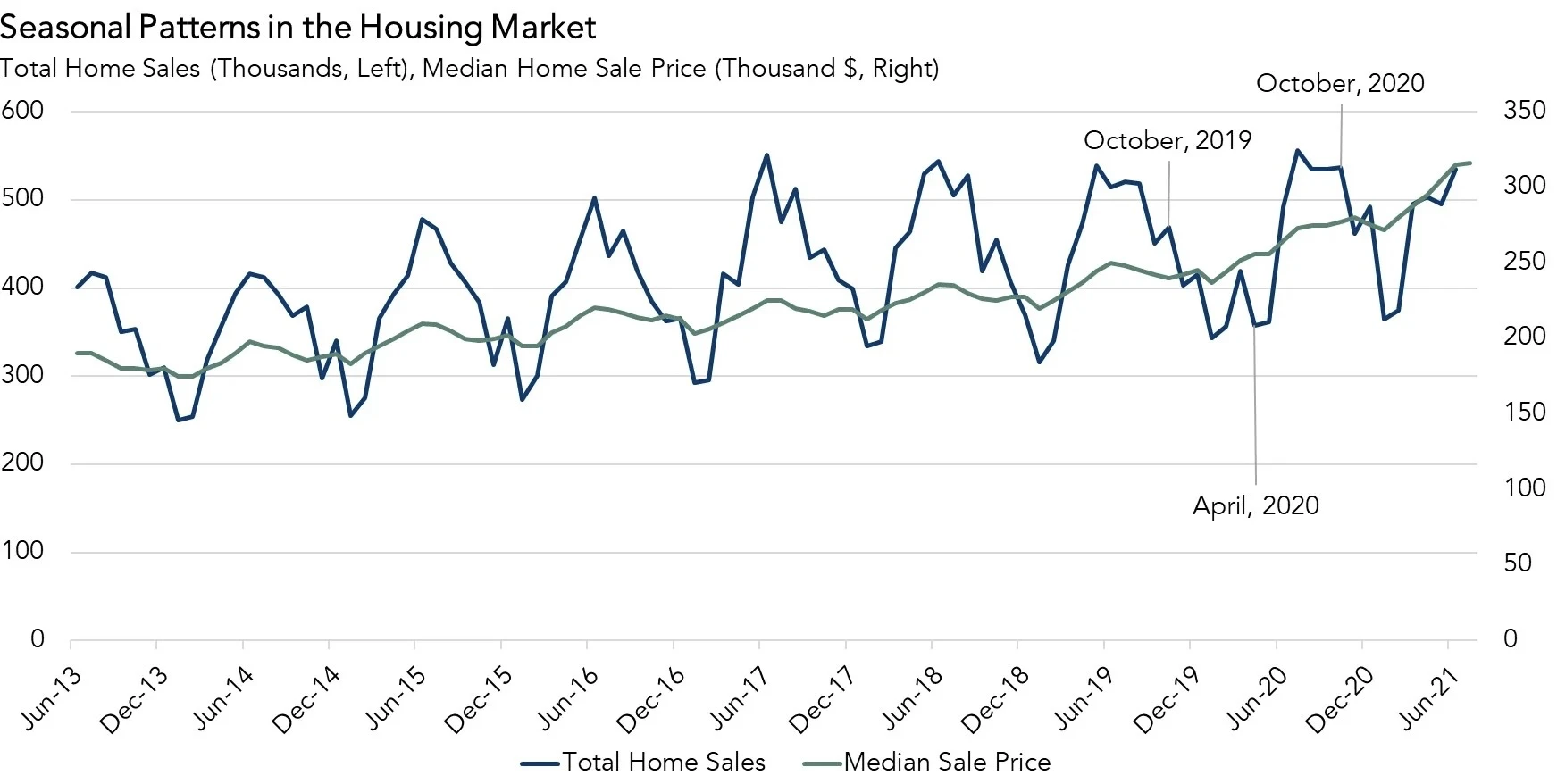

Seasonal Patterns in the Real Estate Market. Analyzing seasonal patterns in the real estate market reveals distinct advantages and disadvantages associated with different times of the year. Traditionally, spring and summer are considered peak seasons, with heightened activity and increased inventory. According to North Carolina Housing Finance Agency, during spring and summer, buyers have more options to choose from but may encounter more competition, leading to potential bidding wars and higher prices.2 Conversely, off-peak seasons such as winter can present unique opportunities. Studies indicate that housing prices tend to be lower during winter months, averaging around 8% below peak season prices. Furthermore, buyers who are flexible with their timing may have enhanced negotiating power and a higher likelihood of finding motivated sellers. Evaluating seasonality trends can be advantageous in terms of potential cost savings and increased bargaining power.

Housing prices tend to be lower during winter months, averaging around 8% below peak season prices.

Personal Financial Readiness. Before embarking on a home purchase, it is crucial to assess personal financial readiness. Financial preparation plays a significant role in securing favorable terms and ensuring a smooth homebuying process. Lenders typically consider credit score, savings, and debt-to-income ratio when evaluating mortgage applications. Data from Experian demonstrates that borrowers with higher credit scores tend to secure more favorable interest rates and loan terms.3 Additionally, having a solid savings plan and a reasonable debt-to-income ratio enhances financial stability and increases the chances of obtaining a mortgage approval. It is vital to consider the impact of mortgage rates on affordability as well. Research reveals that even a 0.25% difference in mortgage rates can have a substantial impact on monthly payments, emphasizing the need to explore various loan options and lock in the most favorable rates.4

Long-Term Considerations

Long-term considerations involve analyzing the housing market forecast to gain insights into future conditions. This entails examining projections and expert opinions on market trends and stability. Housing markets in certain regions are expected to experience steady growth due to factors such as population growth, economic development, and infrastructure projects. Assessing the stability and growth potential of the selected area can provide valuable information to buyers, ensuring they make informed decisions aligned with their long-term goals.

Life stage and personal circumstances play a crucial role in determining the right time to buy a house. Various life events and milestones can significantly impact this decision. Factors such as career stability, family planning, and lifestyle preferences should be taken into account. For instance, individuals in stable careers with plans for long-term settlement may be more inclined to purchase a home. On the other hand, those in transitional phases or uncertain about future plans may opt for renting or delaying their home purchase. Data analysis further highlights that homeownership rates tend to be higher among individuals in their 30s and 40s, indicating a correlation between life stage and the decision to buy a house.5

Considering local factors is vital as housing markets can vary significantly by region. Examining the specific dynamics of the local housing market provides valuable insights. This involves analyzing data on housing inventory, price trends, and average time on the market. Moreover, understanding any regional influences is crucial. For example, changes in job market trends, such as an influx of job opportunities or the relocation of major companies, can impact housing demand and prices. Additionally, regional developments like new infrastructure projects or revitalization initiatives may affect property values. By analyzing relevant data and local factors, buyers can gain a comprehensive understanding of the housing market specific to their desired area, enabling them to make informed decisions aligned with their long-term plans.

Strategies for Making the Right Decision

Research and Due Diligence. Thorough research is crucial when making the right decision in buying a house. Buyers who invest time in research tend to make more informed choices and secure better deals. Emphasizing the importance of gathering information about the local market, property values, and future developments is essential. Analyzing historical sales data, tracking price trends, and exploring neighborhood amenities can provide valuable insights into property value appreciation and potential investment returns. Additionally, keeping an eye on future developments such as planned infrastructure projects or zoning changes can help buyers anticipate market shifts and make well-informed decisions.

Consultation with Real Estate Professionals. Seeking guidance from real estate agents or experts is a valuable strategy in the homebuying process. Working with a knowledgeable real estate professional can provide access to comprehensive market data and insights. Their expertise in negotiating deals, navigating complex paperwork, and identifying suitable properties can be invaluable. Data analysis further indicates that buyers who consult with real estate professionals tend to secure homes at more favorable prices compared to those who navigate the process independently. Advising readers to leverage the expertise of real estate professionals can enhance their chances of making the right decision and finding the ideal property that meets their needs. (How to choose the right real estate agent?)

Flexibility and Patience. Flexibility and patience are vital strategies when making the right decision in the homebuying process. Buyers who approach the process with patience and flexibility have a higher likelihood of finding a suitable property that meets their criteria. This includes being open to considering various neighborhoods, property types, or adjusting the timeline of their purchase. Data also indicates that waiting for the right opportunity can lead to significant cost savings. Encouraging readers to remain patient and adaptable during the homebuying process can ultimately lead to more satisfying and financially sound decisions.

Conclusion

In conclusion, timing your home purchase is a multifaceted decision influenced by several factors. Throughout this article, we explored the significance of market conditions, seasonal patterns, personal financial readiness, long-term considerations, and strategies for making the right decision. We analyzed data from reputable sources to provide insights into the impact of these factors on the timing of a home purchase.

It's important to note that there is no universal "best" time to buy a house. The ideal timing depends on a combination of market conditions, personal circumstances, and individual preferences. The data presented throughout this article showcased the dynamic nature of the real estate market, with trends and opportunities constantly evolving. Understanding this complexity helps in making informed decisions and avoiding potential pitfalls associated with a one-size-fits-all approach.

There is no universal "best" time to buy a house. The ideal timing depends on a combination of market conditions, personal circumstances, and individual preferences.

When considering the timing of your home purchase, it is crucial to evaluate your unique circumstances. Reflect on your financial readiness, long-term goals, and life stage. Consider consulting with real estate professionals who can provide guidance tailored to your specific needs. By carefully assessing the data and insights provided in this article and taking into account your personal situation, you can confidently navigate the real estate market and make an informed decision that aligns with your goals. Remember, finding the right time to buy a house is a personal journey that requires thoughtful consideration and careful analysis.

Looking for local agents?

Search, compare and connect with top-ranked agents. Find the best local agent & lower rates.