What Kind of Home Should You Buy?

Buying a home is one of the most significant decisions a person can make in their lifetime. It goes beyond just being a shelter; a home becomes the foundation for building memories, nurturing relationships, and achieving financial security. The choice of the right home can have a profound impact on an individual or family's overall well-being and happiness. For instance, studies have shown that homeownership is associated with higher levels of life satisfaction and a sense of community belonging. On the other hand, making a hasty or ill-informed decision about the type of home to purchase can lead to regret and financial strain. Therefore, taking the time to carefully evaluate one's needs and considering various factors is essential in ensuring a successful and fulfilling home buying experience.

When embarking on the journey of buying a home, numerous factors come into play. First and foremost, potential buyers need to assess their specific needs and lifestyle requirements. For instance, a growing family may prioritize homes with multiple bedrooms and a spacious backyard, while young professionals might look for properties closer to the city center with easy access to their workplaces. Budget is another crucial factor, as it dictates the type of properties a buyer can consider and the financing options available. Additionally, the location and neighborhood are paramount considerations, impacting daily commutes, access to amenities, and the overall quality of life. Evaluating home features and amenities, as well as considering future plans, are also vital in making an informed decision that aligns with both short-term and long-term goals.

The choice of the right home can have a profound impact on an individual or family's overall well-being and happiness.

In this article, we will delve into the key aspects of buying a home and offer guidance on making the right choice. We will begin by exploring the significance of this decision, emphasizing the profound impact a well-suited home can have on various aspects of life. Subsequently, we will discuss the essential factors that every homebuyer should consider during their search. This will include a detailed examination of the different types of homes available, such as single-family homes, condominiums, townhouses, and apartments, along with their respective advantages and disadvantages. We will also delve into evaluating home features, amenities, and how to align them with personal preferences and future plans. Ultimately, this comprehensive guide aims to empower prospective homebuyers to make informed choices and find their ideal abode that best fits their unique needs and aspirations.

Understanding Your Needs and Lifestyle

Assessing your current and future needs

Before embarking on the home buying journey, it is essential to assess both your current and future needs. Consider factors such as the size of your household, whether you plan to expand your family, or if you require space for a home office. For example, a young couple may prioritize a home with a nursery and a backyard for their growing family, while empty nesters might seek a smaller, low-maintenance property that accommodates their lifestyle. Anticipating future needs is equally vital to avoid outgrowing the home too quickly. By evaluating these requirements, you can narrow down the search to properties that genuinely meet your lifestyle demands, ensuring your investment stands the test of time.

Determining your budget and financial capabilities

Understanding your budget and financial capabilities is a fundamental step in the home buying process. Begin by assessing your savings, income, and existing debts to determine how much you can comfortably afford for a down payment and monthly mortgage payments. This financial clarity helps set realistic expectations and prevents overextending yourself financially. For instance, if you plan to put down 20% on a $400,000 home, your down payment would amount to $80,000. Being aware of your budgetary constraints also allows you to explore various financing options, such as fixed-rate mortgages or adjustable-rate mortgages, and choose the most suitable one for your circumstances. Moreover, it helps you identify potential cost-saving opportunities and incentives, such as first-time homebuyer programs or tax credits, which can significantly impact your overall buying power.

Understanding your budget and financial capabilities is a fundamental step in the home buying process.

Identifying your preferred location and neighborhood

The location and neighborhood of a home play a pivotal role in shaping daily life and long-term satisfaction. Consider factors such as proximity to your workplace, schools, healthcare facilities, and recreational areas that align with your lifestyle preferences. For example, if you have school-going children, you may prioritize homes in highly-rated school districts, as studies have shown that homes located in top-rated school zones tend to maintain higher property values. Moreover, examine the safety and crime rates of the neighborhood to ensure a secure living environment for your family. Additionally, consider the convenience of nearby amenities, such as grocery stores, public transportation, and parks, to enhance the overall quality of life. By identifying your preferred location and neighborhood, you can focus your home search on areas that resonate with your lifestyle, creating a harmonious and enriching living experience.

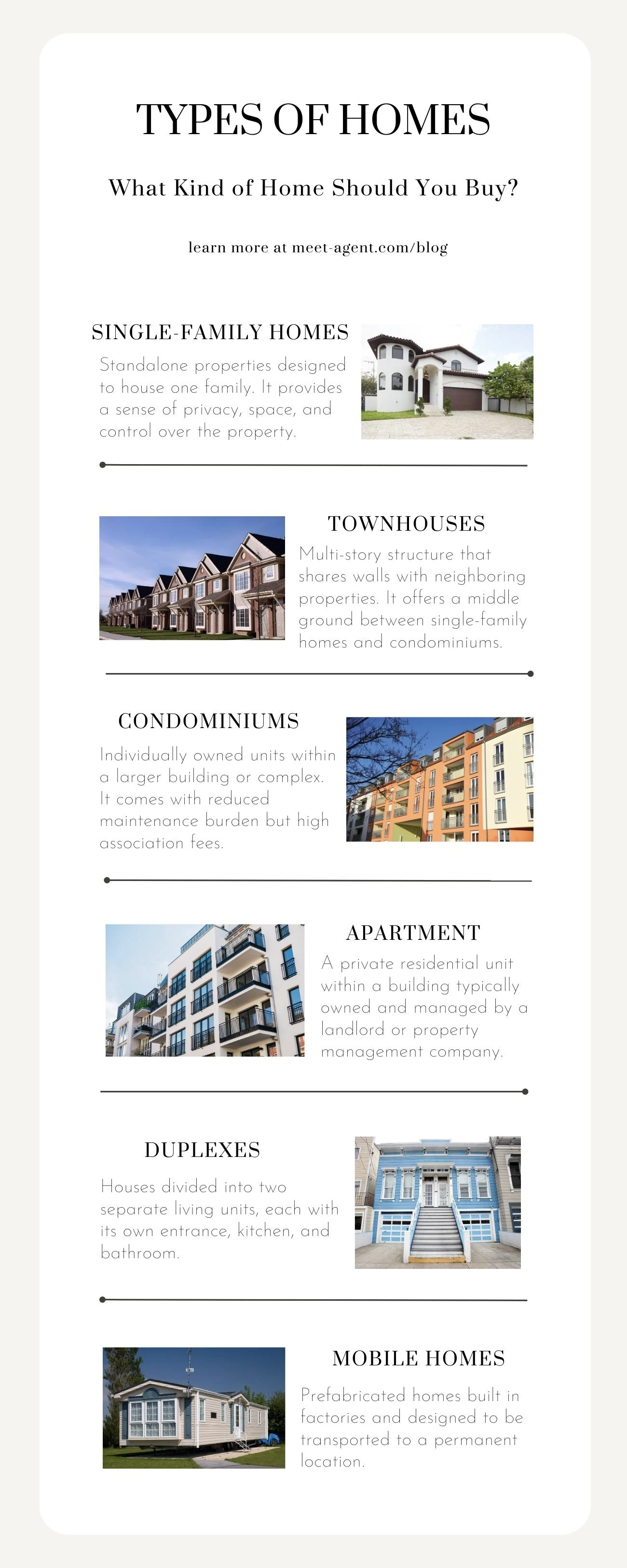

Types of Homes Available

Single-Family Homes

Single-family homes are standalone properties designed to house one family, offering both advantages and disadvantages for potential buyers. On the positive side, owning a single-family home provides homeowners with a sense of privacy, space, and control over their property. Families with children or those who desire a yard for gardening and outdoor activities often find single-family homes appealing. Additionally, single-family homes tend to appreciate in value over time, making them a solid long-term investment. However, they also come with higher maintenance costs and responsibilities, as homeowners are solely responsible for repairs and upkeep. For instance, if a family with young children purchases a single-family home in a suburban area, they can enjoy the benefits of a spacious backyard and a quiet neighborhood, but they must be prepared for ongoing maintenance tasks, such as lawn care and exterior repairs.

Condominiums and Townhouses

Condominiums and townhouses offer an alternative option for homebuyers looking for a more communal living experience. Condos are individually owned units within a larger building or complex, while townhouses are typically multi-level properties connected to neighboring units. One of the key advantages of condominium living is the reduced maintenance burden, as common areas and exterior upkeep are typically managed by a homeowners' association. This appeals to busy professionals and retirees seeking a low-maintenance lifestyle. However, condo owners may face limitations on customization and might encounter higher monthly association fees. On the other hand, townhouses provide a middle ground between single-family homes and condos, offering the benefit of shared amenities and potentially lower maintenance costs. Young professionals or empty nesters who value community amenities like swimming pools and fitness centers might find townhouse living to be an attractive option.

Townhouses provide a middle ground between single-family homes and condos, offering the benefit of shared amenities and potentially lower maintenance costs.

Apartments and Rental Properties

For those who prioritize flexibility and a lower upfront cost, renting an apartment or property can be a suitable choice. Renting provides the freedom to move without the commitment of homeownership and is often favored by young adults or individuals who frequently relocate for work. Additionally, renting can be financially advantageous in areas where home prices are prohibitively high, allowing individuals to save for future homeownership while enjoying the convenience of renting. However, renters may miss out on building equity and might face rental increases or limited control over property modifications. On the other hand, buying a home is a more stable option for long-term residents who wish to build equity and personalize their living space. Families or individuals planning to settle in a particular area for an extended period may find buying a home to be a more suitable investment in their future. For example, a couple expecting to live in a city for at least five years might choose to buy a condo, benefitting from potential property appreciation and tax deductions, while maintaining the option to sell in the future if their circumstances change.

Evaluating Home Features and Amenities

Size and Layout Considerations

When evaluating potential homes, the size and layout of the property are crucial factors to consider, as they directly impact comfort and functionality. Families with children may prioritize a spacious layout with multiple bedrooms and bathrooms to accommodate everyone's needs. For instance, a family of four searching for a new home might seek a property with at least three bedrooms and two bathrooms to ensure ample living space and convenience. On the other hand, young professionals or empty nesters might find a smaller, more streamlined layout to be more manageable and easier to maintain. The layout of the home can also influence the flow of daily activities and interactions among family members. Open-concept layouts have become increasingly popular for their seamless transition between living spaces, providing a sense of connectivity and openness. Data from a real estate survey indicated that 70% of homebuyers prefer an open floor plan, highlighting its desirability and market appeal.

Essential Home Features

Certain home features are considered essential for most buyers, regardless of their lifestyle or preferences. These features often include the number of bedrooms and bathrooms, as well as the presence of a functional kitchen and ample storage space. For instance, a couple planning to start a family might prioritize a home with multiple bedrooms to accommodate future growth, while a retiree might seek a single-story property for ease of mobility. Other crucial considerations include the availability of a dedicated laundry area, sufficient closet space, and modern appliances. In a competitive real estate market, properties with these essential features tend to attract more buyers and may command higher prices. According to market data, homes with three or more bedrooms and two or more bathrooms typically have a higher resale value due to their increased appeal to a broader range of buyers.

Amenities

Amenities play a significant role in shaping a homeowner's lifestyle and can range from practical outdoor spaces to luxurious extras. For families, a backyard can offer a safe and enjoyable play area for children and pets. Having access to green spaces and parks nearby can also enhance the overall quality of life for homeowners. In contrast, amenities like swimming pools, fitness centers, and community clubhouses appeal to those seeking a more resort-style living experience. For example, a family of active individuals may prioritize a property in a community with a shared swimming pool and sports facilities to support their recreational interests. Similarly, a homebuyer with a passion for gardening may prioritize a property with ample garden space and room for outdoor activities. Although amenities can enhance a property's appeal, it's essential to consider associated costs, such as homeowners' association fees or maintenance expenses, when evaluating their overall value and impact on the homebuying decision.

Considering Your Future Plans

Long-term vs. Short-term Investment

When purchasing a home, it's essential to assess your future plans and consider whether you view the property as a long-term investment or a short-term solution. If you envision staying in the same location for an extended period and establishing roots in the community, a long-term investment approach may be suitable. In this scenario, you would prioritize factors like the quality of schools, neighborhood amenities, and potential for property appreciation over time. For example, data from real estate market trends shows that certain neighborhoods experience consistent growth in property values due to factors such as infrastructure development, job opportunities, and proximity to popular attractions. On the other hand, if your future plans involve frequent relocations due to career changes or other life events, a short-term investment strategy may be more appropriate. In this case, you might focus on properties with strong rental potential to generate income during your absence and have the flexibility to sell when the market conditions are favorable.

If you envision staying in the same location for an extended period and establishing roots in the community, a long-term investment approach may be suitable.

Potential for Property Appreciation

The potential for property appreciation is a crucial consideration, particularly for buyers looking to build wealth through real estate investment. Researching historical property trends and consulting with local real estate experts can provide valuable insights into the market's growth patterns and the potential for future appreciation. For instance, data from a reputable real estate analysis revealed that certain cities experienced double-digit property value appreciation over the past five years, making them attractive options for buyers seeking long-term wealth-building opportunities. Understanding factors like job growth, population influx, and urban development plans can also give you a clearer picture of the market's potential for property appreciation. However, it's essential to strike a balance between investment potential and meeting your immediate lifestyle needs, as focusing solely on appreciation may lead to overlooking critical factors that impact your day-to-day living experience.

Flexibility for Lifestyle Changes

Life is full of uncertainties, and your housing needs may change over time due to career advancements, family dynamics, or personal preferences. Therefore, considering the flexibility of the property in accommodating potential lifestyle changes is essential. For example, a couple planning to start a family may prioritize a home with extra space for future expansion, such as a finished basement or a den that can be converted into a nursery. Similarly, a remote work trend may prompt you to prioritize properties with dedicated home office spaces or excellent internet connectivity. Flexibility in the home's layout and functionality can help ensure that it remains suitable for your evolving needs without requiring extensive renovations or relocation in the future. Ultimately, a home that aligns with your long-term vision and offers adaptability for potential lifestyle changes will provide you with a more satisfying and sustainable homeownership experience.

Life is full of uncertainties, and your housing needs may change over time due to career advancements, family dynamics, or personal preferences.

Environmental and Neighborhood Factors

Sustainability and Eco-Friendly Options

In today's environmentally conscious world, more homebuyers are considering sustainability and eco-friendly features as crucial factors in their decision-making process. Sustainable homes designed with energy-efficient features, such as solar panels, LED lighting, and energy-saving appliances, not only reduce the carbon footprint but also offer long-term cost savings on utility bills. For example, a study conducted by the U.S. Department of Energy revealed that solar panels can save homeowners up to $100 per month on electricity expenses. Additionally, eco-friendly homes often incorporate green building materials and practices, promoting healthier indoor air quality and minimizing the environmental impact. Homebuyers increasingly prioritize such features, recognizing the long-term benefits to both the planet and their wallets.

Safety and Crime Rates in the Area

The safety of a neighborhood is a critical consideration for homebuyers, impacting their peace of mind and overall quality of life. Before purchasing a property, it is essential to research the area's crime rates and safety statistics. Online tools and resources, such as neighborhood crime maps and reports from local law enforcement agencies, provide valuable insights into the safety level of a particular location. For example, data from the FBI's Uniform Crime Reporting (UCR) program can reveal crime trends and statistics for specific neighborhoods, giving buyers a comprehensive understanding of the area's safety profile. Homebuyers may also consider gated communities, security systems, or neighborhood watch programs for additional security measures. Prioritizing safety ensures that homeowners and their families can feel secure and comfortable in their new environment.

Access to Amenities and Public Services

The availability of amenities and proximity to public services significantly impact the desirability of a neighborhood. Homebuyers often seek areas with convenient access to essential services like schools, medical facilities, and grocery stores. Access to public transportation, major highways, and recreational areas also plays a crucial role in enhancing the neighborhood's appeal. For instance, a study by the Urban Land Institute found that homes located within walking distance of public transportation have higher property values and experience increased demand. Homebuyers with children may prioritize neighborhoods with top-rated schools and family-friendly amenities, while young professionals may seek vibrant areas with entertainment venues and dining options. Choosing a neighborhood that aligns with one's lifestyle and offers easy access to amenities and services ensures a comfortable and enjoyable living experience for homeowners.

Finalizing Your Decision

Making a Well-Informed Choice

As you near the final stages of the home buying process, it's essential to make a well-informed choice that aligns with your needs, preferences, and future plans. Utilize all the information and research gathered throughout the journey to evaluate each option objectively. Consider creating a pros and cons list for the top contenders to compare their advantages and disadvantages. For instance, if you are torn between a spacious single-family home with a large backyard in the suburbs and a modern condominium in the heart of the city, assess how each property fits into your lifestyle, budget, and long-term goals. Data-driven decision-making can lead to greater satisfaction and minimize the chances of buyer's remorse.

Consider creating a pros and cons list for the top contenders to compare their advantages and disadvantages.

Preparing for the Move and Transition

Once you've made your decision and finalized the purchase, it's time to prepare for the move and transition to your new home. Organize a moving plan, enlist professional movers if necessary, and start packing belongings. Taking the time to plan and declutter before the move can streamline the process and ease the transition. Additionally, consider familiarizing yourself with the new neighborhood and community. Research local amenities, nearby attractions, and community events to start feeling at home even before the move. A smooth and organized transition sets the stage for a positive experience as you settle into your new residence.

Seeking Professional Advice When Needed

Throughout the home buying journey, seeking professional advice when needed can be invaluable. Real estate agents, financial advisors, and home inspectors are valuable resources that can provide expert insights and guidance. For instance, a skilled real estate agent can navigate complex negotiations, ensuring you get the best deal on your new home. Financial advisors can help with budgeting and financing options, ensuring your purchase aligns with your long-term financial goals. Additionally, a thorough home inspection by a qualified professional can uncover potential issues that may have been missed during the initial evaluation. Seeking professional advice empowers you to make confident decisions and increases the likelihood of a successful and fulfilling home buying experience.

Real estate agents, financial advisors, and home inspectors are valuable resources that can provide expert insights and guidance.

Conclusion

In conclusion, the process of buying a home is a significant undertaking that requires careful consideration and thorough research. Throughout this comprehensive guide, we have explored various essential factors to consider when making this life-changing decision. Understanding your current and future needs, evaluating different types of homes available, and assessing home features and amenities are critical steps in finding the perfect property that aligns with your lifestyle and preferences. Moreover, considering your future plans and evaluating environmental and neighborhood factors can significantly impact your long-term satisfaction with your new home. By seeking professional advice, making data-driven decisions, and being mindful of sustainability and safety aspects, you can embark on your home buying journey with confidence and excitement.

Looking for local agents?

Search, compare and connect with top-ranked agents. Find the best local agent & lower rates.