Tenant Screening and Selection: A Comprehensive Guide for Landlords

Tenant screening and selection play a pivotal role in achieving successful property management. As a landlord, ensuring that you have a thorough screening process in place is crucial for maintaining a well-maintained property and minimizing potential risks. Studies have consistently shown that implementing rigorous tenant screening procedures can significantly reduce the likelihood of problems such as late payments, property damage, and eviction.

The importance of tenant screening and selection cannot be overstated. By thoroughly evaluating prospective tenants, landlords can identify individuals who are more likely to fulfill their financial obligations, respect the property, and maintain a positive rental experience. According to a survey conducted by the National Association of Independent Landlords, 86% of landlords reported that tenant screening helped them avoid costly evictions and property damage.

Finding quality tenants brings numerous benefits to landlords. A responsible and reliable tenant not only ensures a steady stream of rental income but also contributes to a harmonious living environment for other tenants. Quality tenants are more likely to communicate effectively, adhere to lease agreements, and take care of the property. Additionally, they tend to stay longer, reducing vacancy rates and turnover costs. In fact, a study conducted by TransUnion found that tenants with higher credit scores are more likely to renew their leases, resulting in improved stability and financial predictability for landlords.

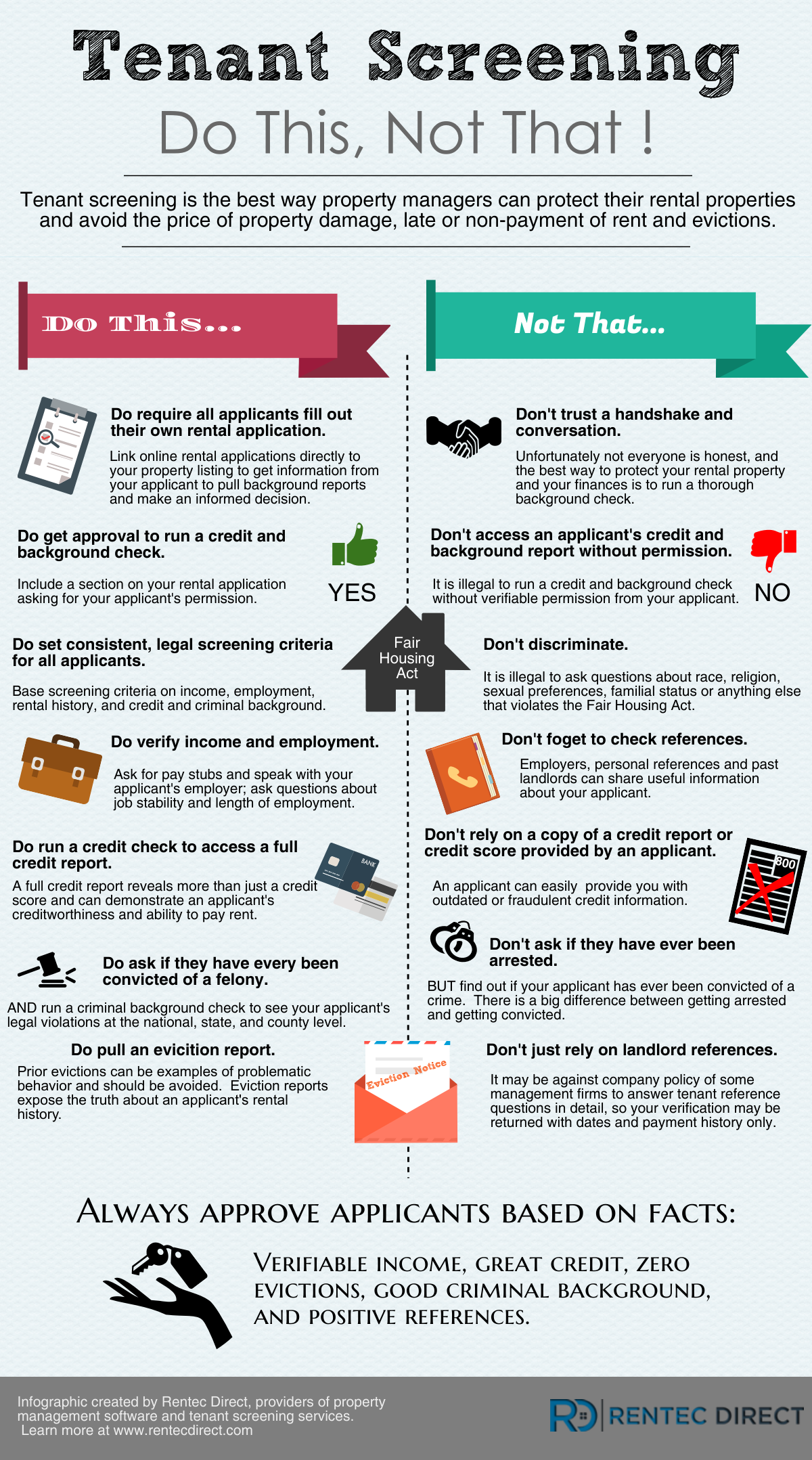

Defining Tenant Screening Criteria

Establishing clear and effective tenant screening criteria is essential for landlords to make informed decisions about potential tenants. Several key factors should be considered when determining these criteria. One crucial aspect is evaluating a tenant's financial stability, including their income, employment history, and creditworthiness. According to a report by Experian, nearly 67% of property managers ranked financial stability as the most important factor when screening applicants. A reliable income source ensures that tenants can meet their rent obligations consistently.

Nearly 67% of property managers ranked financial stability as the most important factor when screening applicants.

In addition to financial considerations, landlords must be aware of legal requirements and fair housing regulations when establishing screening criteria. It is essential to treat all applicants fairly and avoid discriminatory practices. The Fair Housing Act prohibits discrimination based on protected characteristics such as race, color, religion, sex, disability, familial status, and national origin.1 Failure to comply with fair housing regulations can result in costly legal consequences. A study conducted by the U.S. Department of Housing and Urban Development (HUD) found that over 50% of complaints filed with fair housing enforcement agencies are related to disability and race discrimination. Therefore, landlords must familiarize themselves with local, state, and federal laws to ensure their screening criteria align with legal obligations and promote fair housing practices.

Pre-Screening Process

Before diving into a thorough tenant screening process, landlords should engage in a pre-screening phase to gather essential information from prospective tenants. This step helps filter out individuals who may not meet the basic requirements or have red flags that would disqualify them from further consideration. According to a survey by TransUnion, 88% of landlords conduct a pre-screening process to narrow down the applicant pool and save time during the comprehensive screening phase.

During the pre-screening phase, landlords commonly employ initial phone or email interviews to assess potential tenants. These interviews serve as an opportunity to gather more information about the applicants, such as their reason for moving, desired lease term, and any specific requirements they might have. Engaging in these conversations allows landlords to gauge the applicants' communication skills, professionalism, and compatibility with the property. Additionally, landlords can use this opportunity to clarify any initial concerns or questions they may have. By conducting pre-screening interviews, landlords can streamline the tenant selection process and ensure they are focusing on applicants who align with their property's requirements and expectations.

Background and Credit Checks

Verifying employment, income, and rental history is of utmost importance when conducting tenant screening. It helps landlords assess an applicant's financial stability, reliability, and ability to meet rental obligations. According to a report by RentSpree, 76% of landlords consider employment and income verification as critical factors in the tenant screening process. By confirming an applicant's employment status and income, landlords can gain insights into their financial capability to consistently pay rent and meet other financial obligations.

In addition to employment and income verification, performing credit checks plays a vital role in evaluating the creditworthiness of potential tenants. A study by TransUnion reveals that 48% of landlords consider credit checks as the most important screening criterion.2 Credit reports provide valuable information about an applicant's financial behavior, such as their credit score, payment history, outstanding debts, and any past evictions or bankruptcies. Analyzing this data helps landlords assess an applicant's financial responsibility and their likelihood of fulfilling their rental obligations in a timely manner. By incorporating background and credit checks into the screening process, landlords can make informed decisions and minimize the risks associated with renting to applicants with a history of financial instability or irresponsible behavior.

Performing credit checks plays a vital role in evaluating the creditworthiness of potential tenants.

Reference Checks

Contacting previous landlords is an essential step in tenant screening as it provides valuable insights into an applicant's past behavior as a tenant. According to a survey by the National Association of Independent Landlords, 85% of landlords consider contacting previous landlords as an important part of the screening process. By reaching out to these landlords, landlords can gain information about the applicant's payment history, lease compliance, property maintenance, and overall behavior as a tenant. This helps landlords assess the applicant's reliability, responsibility, and compatibility with their property management standards.

In addition to contacting previous landlords, reaching out to personal and professional references can provide further validation of an applicant's character and suitability as a tenant. By speaking with individuals who know the applicant personally or professionally, landlords can gather additional information about their integrity, communication skills, and overall trustworthiness. This step helps landlords gain a more comprehensive understanding of the applicant's behavior and reliability beyond their rental history. According to a study by Zillow, 70% of landlords consider personal references as an important factor in the tenant screening process. By conducting thorough reference checks, landlords can make more informed decisions and increase the likelihood of finding reliable and responsible tenants for their rental properties.

Conducting In-Person Interviews

Meeting potential tenants in person is a crucial step in the tenant screening process as it allows landlords to assess their demeanor, communication skills, and overall suitability for the rental property. In these interviews, landlords can observe the applicant's body language, professionalism, and interpersonal skills, which can provide valuable insights into how they may interact as a tenant.

Meeting potential tenants in person is a crucial step in the tenant screening process.

During the in-person interview, landlords should ask relevant questions to gauge compatibility and suitability. These questions may revolve around the applicant's lifestyle, their plans for renting the property, and their ability to meet rental obligations. By asking specific questions related to the rental property and the landlord's expectations, landlords can assess whether the applicant aligns with their requirements and can fulfill their responsibilities as a tenant. Additionally, these interviews provide an opportunity for landlords to address any concerns or clarify any information provided by the applicant during the screening process. By conducting thorough in-person interviews, landlords can make more informed decisions and increase the likelihood of finding tenants who are a good fit for their rental property.

Making the Final Decision

After completing the tenant screening process, landlords need to analyze all the gathered information in order to make an informed choice. This includes carefully reviewing the results of background checks, credit checks, reference checks, and the information obtained from interviews. By evaluating all the relevant data, landlords can assess the applicant's overall suitability, financial stability, and potential risk as a tenant.

Once a decision has been made, it is important for landlords to communicate the outcome to the chosen tenant promptly. This includes informing them of their acceptance, outlining any specific terms or conditions, and providing them with the necessary documentation such as the lease agreement and move-in instructions. Clear communication is essential to establish a positive landlord-tenant relationship from the beginning. Additionally, prompt communication and efficient handling of the leasing process contribute to a smoother and more professional rental experience for both parties involved.

Conclusion

In conclusion, tenant screening and selection play a crucial role in successful property management. By implementing a comprehensive screening process, landlords can mitigate potential risks, minimize tenant turnover, and ensure a positive rental experience for all parties involved. The careful evaluation of prospective tenants' background, credit history, references, and personal interviews enables landlords to make informed decisions based on reliable data. Finding quality tenants not only contributes to the financial stability of the rental property but also fosters a harmonious living environment for all residents. By prioritizing tenant screening and selection, landlords can lay a strong foundation for a successful and profitable rental business.

Looking for local agents?

Search, compare and connect with top-ranked agents. Find the best local agent & lower rates.