How to Buy Your First Home: A Comprehensive Guide

Congratulations! You've made the decision to buy your first home, and you're about to embark on an exciting and transformative journey. But where do you start? How do you navigate the complexities of the real estate market and make the right choices along the way? This comprehensive guide is here to help you navigate the entire homebuying process, from start to finish. Whether you're feeling overwhelmed, unsure of where to begin, or seeking clarity on the steps involved, this guide will provide you with the knowledge, insights, and practical tips you need to make informed decisions. From assessing your financial readiness to securing financing, finding your dream home, and closing the deal, we'll take you through each step, equipping you with the tools and confidence to make your first homebuying experience a successful one. Let's dive in and discover how to buy your first home with ease and peace of mind.

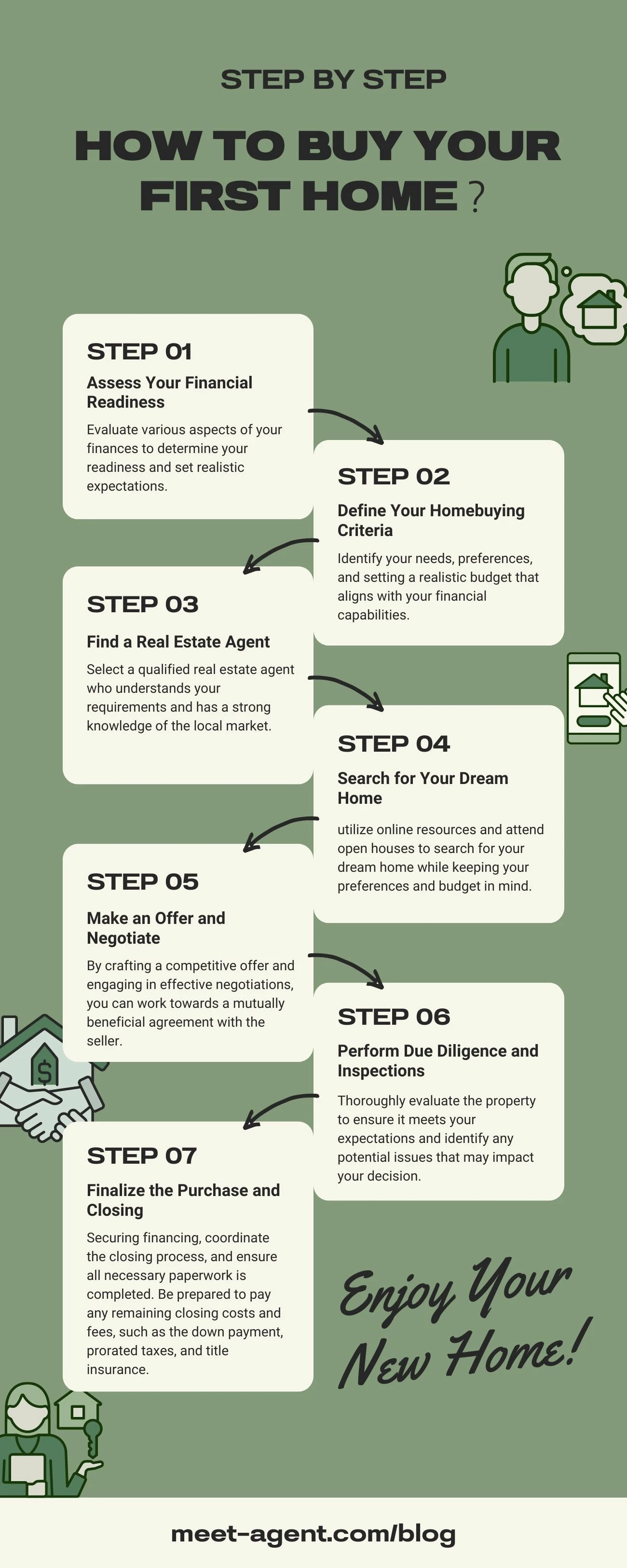

Step 1: Assess Your Financial Readiness

Before diving into the exciting journey of buying your first home, it's essential to assess your financial situation to ensure you're well-prepared for this significant investment. This step involves evaluating various aspects of your finances to determine your readiness and set realistic expectations.

It's essential to assess your financial situation to ensure you're well-prepared for this significant investment.

Evaluate your financial situation. Begin by calculating your income and expenses. Understanding your cash flow will give you a clear picture of your financial capacity and help you determine how much you can comfortably allocate towards homeownership. Assessing your credit score and debt-to-income ratio is also crucial as they play a vital role in mortgage qualification.

Save for a down payment and closing costs. Saving for a down payment is a crucial step in the homebuying process. Set a savings goal based on the desired percentage of the home's purchase price and start building your funds accordingly. Additionally, explore down payment assistance programs that may be available in your area, as they can provide valuable support. It's also important to understand closing costs, which include expenses such as appraisal fees, attorney fees, and title insurance. Knowing what to expect and planning for these costs in advance will help you avoid any last-minute financial surprises.

Get pre-approved for a mortgage. Seeking pre-approval for a mortgage is a proactive step that will enhance your homebuying experience. Gather the necessary financial documents, such as income statements, tax returns, and bank statements, to provide to potential lenders. Research different mortgage options and lenders to find the one that suits your needs and offers competitive terms. Completing the pre-approval process will give you a clear understanding of how much you can borrow and strengthen your position as a serious buyer when you make an offer on a home.

By diligently assessing your financial readiness, saving for a down payment, and obtaining pre-approval for a mortgage, you'll be equipped with the knowledge and confidence to embark on your homebuying journey. These steps lay the foundation for a successful and well-informed approach to homeownership.

Step 2: Define Your Homebuying Criteria

Once you have assessed your financial readiness, the next step is to define your homebuying criteria. This involves identifying your needs, preferences, and setting a realistic budget that aligns with your financial capabilities.

Determine your needs and preferences. Start by considering the location, size, and style of the home that suits your lifestyle and preferences. Think about the proximity to amenities, schools, transportation, and other factors that are important to you. Identify your must-have features and amenities, such as the number of bedrooms and bathrooms, a backyard, or a specific layout. It's also crucial to think about your future needs and long-term plans. Consider factors like potential growth of your family, the possibility of working remotely, or any lifestyle changes that may impact your housing requirements.

Set a realistic budget. It's vital to establish a budget that reflects your financial situation and ensures you can comfortably afford homeownership. Factor in monthly mortgage payments, including principal and interest, as well as insurance and property taxes. Take into account maintenance and utility costs that come with owning a home. It's crucial to have a clear understanding of how homeownership will impact your overall finances and make sure you can comfortably afford the associated expenses without straining your budget.

It's vital to establish a budget that reflects your financial situation and ensures you can comfortably afford homeownership.

By defining your homebuying criteria, you'll have a clear vision of what you're looking for in a home and can focus your search accordingly. Setting a realistic budget will guide you in making financially responsible decisions and ensure you find a home that meets your needs and aligns with your long-term financial goals.

Step 3: Find a Real Estate Agent

Finding a reliable and experienced real estate agent is a crucial step in the homebuying process. A skilled agent can provide valuable guidance, expertise, and support throughout your journey, making the process smoother and more efficient. (Do you need a realtor to buy a house?)

Understand the role of a real estate agent. It's essential to grasp the benefits of working with a real estate agent. They are knowledgeable professionals who understand the intricacies of the housing market and the homebuying process. Agents can offer expert advice, help you navigate complex paperwork, negotiate on your behalf, and provide access to a broader range of listings. Their expertise is invaluable, especially for first-time homebuyers who may be unfamiliar with the intricacies of buying a home.

Research and select a reputable agent. Take the time to research and choose a real estate agent who is reputable and trustworthy. Seek recommendations from friends, family, and trusted sources who have recently bought or sold a home. Ask about their experiences and whether they would recommend their agent. Interview potential agents and ask relevant questions about their experience, track record, and knowledge of the local market. Consider their responsiveness, communication style, and willingness to listen and understand your specific needs.

Take the time to research and choose a real estate agent who is reputable and trustworthy.

Selecting a qualified real estate agent who understands your requirements and has a strong knowledge of the local market will significantly enhance your homebuying experience. They will be your advocate, guiding you through the process, and ensuring you make informed decisions along the way. With their expertise and support, you'll have the confidence to navigate the complexities of the real estate market and find your dream home.

Step 4: Search for Your Dream Home

Once you have defined your criteria and enlisted the help of a real estate agent, it's time to search for your dream home. This step involves utilizing various resources and strategies to find properties that align with your needs and preferences.

Utilize online resources. Real estate websites and online platforms offer a wealth of information and tools to aid your search. Explore these platforms and utilize search filters to narrow down your options based on location, size, price range, and other specifications. Set up alerts to receive notifications about new listings that match your criteria. Take advantage of virtual tours, high-quality photos, and detailed property descriptions to get a sense of each home's features and potential.

Attend open houses and schedule private showings. In addition to online research, attending open houses and scheduling private showings allows you to physically experience the properties. Prepare a checklist of questions to ask during these visits to gather essential information. Take notes and photos to help you remember the details of each home and make comparisons later. It's also important to consider the neighborhood and nearby amenities when evaluating a potential home. Take note of the proximity to schools, parks, shopping centers, and transportation options to assess if the location aligns with your lifestyle.

By utilizing online resources and attending open houses or private showings, you can actively search for your dream home while keeping your preferences and budget in mind. This hands-on approach, coupled with the expertise of your real estate agent, will help you identify properties that have the potential to be your perfect match.

Step 5: Make an Offer and Negotiate

Once you have found a home that meets your criteria, it's time to make an offer and negotiate with the seller. This step requires careful consideration, research, and effective communication to ensure a successful transaction.

Craft a competitive offer. Before making an offer, research comparable sales in the area and consider current market conditions. This information will help you determine an initial offer price that is both competitive and aligns with your budget. It's important to include contingencies, such as a home inspection or financing, to protect your interests. Additionally, specify a timeframe for the seller to respond to your offer and be prepared to provide an earnest money deposit as a sign of good faith.

Negotiate with the seller. Negotiations with the seller are a normal part of the homebuying process. Understanding the seller's motivations and constraints can give you valuable insights during negotiations. When responding to counteroffers, carefully evaluate the terms and make thoughtful adjustments that address both parties' concerns. Your real estate agent can provide guidance and expert advice throughout the negotiation process, ensuring your interests are represented and helping you make informed decisions.

Understanding the seller's motivations and constraints can give you valuable insights during negotiations.

By crafting a competitive offer and engaging in effective negotiations, you can work towards a mutually beneficial agreement with the seller. Remember to stay flexible and open-minded, as negotiations may involve multiple rounds of back-and-forth communication. With patience, clear communication, and the support of your real estate agent, you can navigate the negotiation process successfully and move closer to securing your dream home.

Step 6: Perform Due Diligence and Inspections

Performing due diligence and conducting inspections are crucial steps in the homebuying process. This stage involves thoroughly evaluating the property to ensure it meets your expectations and identifying any potential issues that may impact your decision.

Performing due diligence and conducting inspections are crucial steps in the homebuying process.

Conduct a home inspection. Hiring a qualified home inspector is essential to assess the condition of the property. The inspector will thoroughly examine the home's structural elements, systems, and components to identify any existing or potential issues. Review the inspection report in detail and address any concerns or necessary repairs with the seller. In some cases, it may be prudent to consider specialized inspections for specific issues, such as termite or mold inspections, based on the property's location or suspected problems.

Review property disclosures and documentation. Carefully review the seller's disclosures, which provide important information about the property's history, known defects, or other relevant details. Take the time to read and understand these disclosures, and don't hesitate to request additional information or clarification if needed. Additionally, review title reports and other legal documents to ensure there are no encumbrances or legal issues that could affect your ownership rights or the property's marketability.

By performing due diligence and conducting inspections, you can gain a comprehensive understanding of the property's condition and potential risks. This information will empower you to make an informed decision about proceeding with the purchase. Remember to consult with your real estate agent and other professionals, such as attorneys or contractors, if necessary, to ensure you have a thorough understanding of the property's condition and any associated risks.

Step 7: Finalize the Purchase and Closing

The final step is to finalize the purchase and complete the closing. This stage involves securing financing, coordinating the closing process, and ensuring all necessary paperwork is completed.

Secure financing. If you haven't already, complete the mortgage application process with your chosen lender. Provide all required documentation, such as income verification, bank statements, and tax returns. The lender will review your application and finalize the loan approval. Once approved, you can lock in an interest rate that suits your financial goals and protects you from potential rate fluctuations.

Coordinate the closing process. Coordinate with your real estate agent, lender, and the seller's agent to schedule a closing date and location. Review all closing documents, including the settlement statement, loan estimate, and closing disclosure. Seek clarification on any terms or fees that you do not understand or need more information about. On the day of closing, attend the meeting, usually held at a title company or attorney's office, and sign all necessary paperwork, including the mortgage, deed, and other legal documents. It's important to carefully review each document and ensure the terms align with your agreement with the seller.

By securing financing and coordinating the closing process, you are on the verge of finalizing your home purchase. The closing is the culmination of the entire process, where ownership of the property is officially transferred to you. Be prepared to pay any remaining closing costs and fees, such as the down payment, prorated taxes, and title insurance. Once all the paperwork is signed, you will receive the keys to your new home, marking the exciting beginning of your homeownership journey.

Conclusion

In conclusion, buying your first home is a significant milestone that comes with its own set of challenges and rewards. Throughout this comprehensive guide, we have explored the step-by-step process of purchasing a home, from assessing your financial readiness to finalizing the closing. It is crucial to recap the steps involved, ensuring you have a clear understanding of each stage. However, it is important to remember that this guide serves as a general overview, and seeking professional guidance from real estate agents, lenders, and other experts is highly recommended. Their expertise and experience can provide invaluable support as you navigate the complexities of the real estate market. Ultimately, the journey of buying your first home is an exciting one that offers the potential for financial stability, personal growth, and a place to call your own. Take action, begin your research, and embrace the rewarding experience of homeownership. The keys to your dream home are waiting to be claimed.

Looking for local agents?

Search, compare and connect with top-ranked agents. Find the best local agent & lower rates.